On April 22nd, 2025. It was brought to staff’s attention that the County Tax Rates were incorrect and required revision.

Background:

Treasurers within the County meet in February of each year to discuss tax policy and determine tax ratios for that year by consensus. Lanark County then passes a By-law to set those ratios for the entire County that same month. Lower-tier Treasurers are then able to recommend a Tax Rate By-law for their municipality and enter the rates into the Online Property Tax Analysis (OPTA) site. This usually happens in March or April so that the year’s final tax bills can be issued to taxpayers in May or early June.

Town staff use the OPTA website provided by Reamined Systems Inc. on behalf of the Ministry of Finance to ensure that the taxes being billed to taxpayers balance to the amounts calculated by OPTA based on the rates set by the municipality. This year, one (1) of the Lanark County lower-tier municipalities did not enter its rates into OPTA until June 17th. This delay caused the County allocation to be calculated based on their 2024 rates, despite 2025 rates being entered on March 24th, 2025. This error resulted in a tax adjustment across the Town in the amount of $251,993.94.

As a result, Council approved a motion to issue revised tax notices for 2025 with adjusted amounts on the County’s behalf. The Treasury Department will be issuing revised tax notices by email and letter mail starting on Monday, September 15th, 2025.

How this affects your payments:

- If you pay by Pre-Authorized (10-months) Payments (PAP): Your October and November amounts have been adjusted to match the revised total amount due.

- If you pay by Pre-Authorized Installments: The change has been added to your November payment.

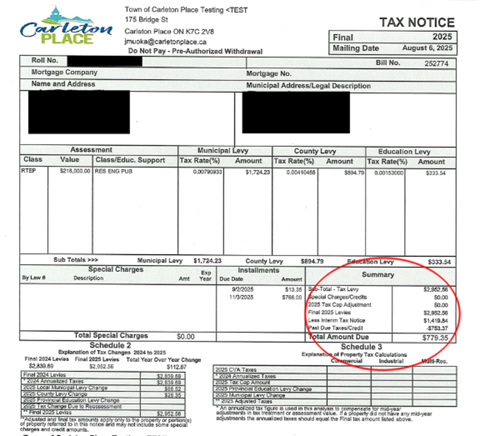

- When paying in November: Please pay the “Total Amount Owing” shown above Schedule 3 on your bill. See the red circular area shown below on a sample tax notice.

- No late fee will be charged for this adjustment unless it is still unpaid after November 3rd.

- September late payments will still have the usual penalty applied.

- Supplemental Bill: If you received a Supplemental Tax Bill, it has been voided and reissued. The corrected total amount will still be due on November 3rd.

- If you have already paid both September and November installments, any additional amount from the adjustment is due November 3rd.

Contact Information: For any immediate concerns or to discuss this matter further, please contact Jennifer Muoka in our Tax Department at 613-257-6218 or jmuoka@carletonplace.ca. Our team is ready to assist you with any questions or clarifications you may need.

Your understanding and patience during this process are greatly appreciated. We are committed to ensuring accuracy and transparency in our billing processes and are taking steps to prevent such errors in the future. We sincerely apologize for any confusion or inconvenience this may have caused.